Executive Summary

The aftermath of the pandemic has fueled a tug-of-war between employers advocating for a return to the office and employees resisting the departure from remote work. Organizations are carefully navigating this transitional phase, redefining employee benefits to address the new demands of hybrid work models and the simultaneous surge in healthcare costs. This evolving approach to work structures, combined with financial stability concerns, demands a strategic approach toward allocating resources for employee benefits. To effectively evaluate benefits options, leaders must consider the impact of related policies and programs on both employee well-being and organizational health.

Wellable’s seventh annual Employee Wellness Industry Trends Report is designed to guide organizations in making well-informed decisions regarding employee wellness benefits. This report is distinctly shaped by data collected directly from health insurance brokers, who represent thousands of employers and millions of employees. It offers a detailed analysis of investment trends, key factors influencing decision-making, and criteria used by organizations to evaluate wellness vendors. This year’s edition features a dedicated section on best practices for wellness programs, providing practical, actionable strategies. These insights are particularly crucial for HR leaders as they plan and implement wellness initiatives in 2024.

Employee Wellness & Benefits Investment Trends

The survey identified 23 of the most popular wellness solutions that employers are investing in throughout 2024. Respondents were asked whether they expect employers to invest less, the same, or more in each benefit this year.

Across all surveyed benefits, 45% of respondents expect more investment in 2024, 51% anticipate the same level of investment, and only 4% expect a decrease in investment. Although a higher rate of respondents (64%) reported increased investments last year, the focus on employee well-being remains high, with most indicating a commitment to maintaining or increasing current wellness efforts.

As companies recognize the advantages of employee well-being programs, many wellness offerings will likely see continued support. The corporate wellness market was valued at an estimated $61 billion in 2023, and this number is expected to rise to $85 billion by 2030.

Last year, the most popular solutions were mental and financial well-being benefits. Moving into 2024, financial wellness is no longer a primary focus as inflation concerns recede and the broader economic situation stabilizes. Nonetheless, mental health remains a cornerstone of corporate wellness programs, owing to its vital role in enhancing productivity, satisfaction, and well-being, benefiting both employers and employees. Organizations are now prioritizing holistic and flexible benefits that cater to diverse needs and promote a personalized wellness experience.

Investment Trend Across All Benefits

- Investing less

- Investing same

- Investing more

Pulse Check

Rising Stars

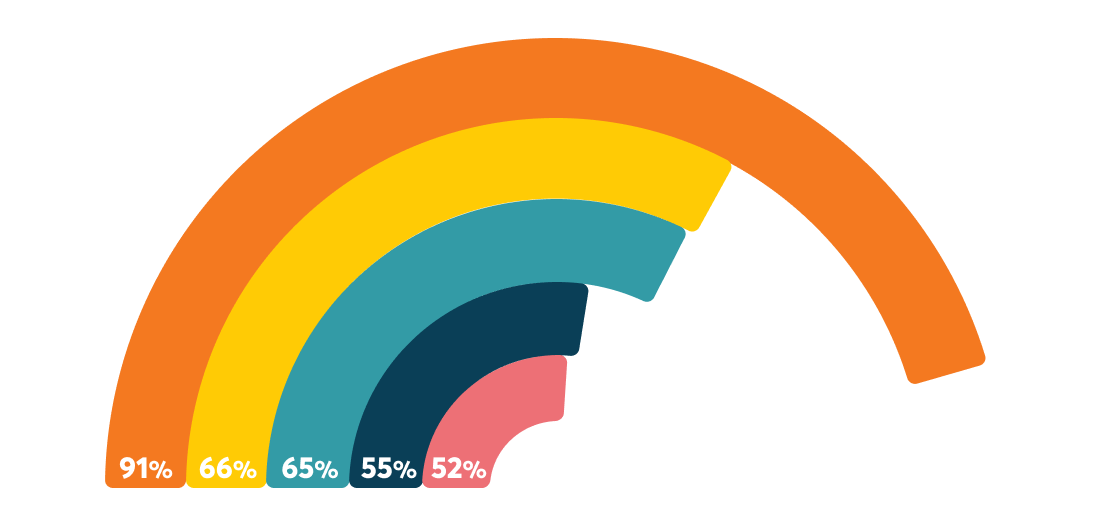

Percentage Of Companies Investing More In 2024

- Mental Health

- Stress Management/Resilience

- Telemedicine

- Mindfulness/Meditation

- Lifestyle Spending Account

Organizations remain committed to mental health for its positive impact on employee well-being and productivity. Additionally, there’s a pivot toward more employee-centric wellness programs. Employers are enhancing flexibility and personalization in their offerings, seen in the growing adoption of lifestyle spending accounts (LSAs). These accounts offer employees greater autonomy in tailoring their wellness journeys, demonstrating a progressive move towards meeting diverse and evolving needs.

Falling Giants

A significant portion of respondents anticipate reduced investment in certain wellness areas: 59% expect less investment in on-site fitness classes, 46% in biometric screenings, 41% in free healthy food/stocked kitchens, 33% in health fairs, and 33% in on-demand fitness classes.

Four out of these five ‘Falling Giants’ rely on physical presence, suggesting a declining relevance of location-dependent wellness solutions, coinciding with the rise of hybrid work arrangements.

Reflecting this trend, organizations are moving away from traditional, physical-health-centric programs toward more adaptable solutions. Modern benefits tend to encompass a broader spectrum of wellness dimensions, acknowledging that employee well-being extends beyond physical health. As a result, employers are reducing their investment in once-ubiquitous offerings like fitness classes, biometric screenings, and free healthy food options.

Percentage Of Companies Investing Less In 2024

Emphasis On Managing High-Cost

Health Conditions

Emphasis On Managing High-Cost Health Conditions

Clinical Program Investment Growth

From 2023 To 2024

Respondents indicate a heightened focus on the proactive management of high-cost health conditions, driven by the potential for long-term cost savings and improved employee health outcomes. This involves several key strategies:

Weight management: A significant 40% of respondents report an uptick in investments in weight management programs, highlighting the urgency to address obesity and associated health risks. As the demand for weight-loss drugs like Ozempic surge, some employers are considering making participation in these programs a prerequisite for specific drug coverage. While the intention is to encourage positive lifestyle changes, it’s crucial to balance this with ethical and medical considerations. This includes ensuring patient autonomy, equitable access, and accommodating diverse needs with various program options.

Health risk assessments (HRAs): While HRAs have been used for early health risk identification, it's important to acknowledge their limitations, including potentially outdated information, inaccuracies, and respondent errors. Nevertheless, the number of respondents showing increasing investments in HRAs has more than doubled from 7% in 2023 to 15% in 2024. This underscores an intensified commitment to preventive health strategies aimed at addressing issues in their early stages to mitigate long-term healthcare costs.

Disease management programs: There’s been a 12-percentage point growth in the number of respondents reporting increased investments in disease management programs, from 36% in 2023 to 48% in 2024. Companies are managing healthcare costs by preventing the progression and complications of chronic diseases, such as diabetes, which tend to be more costly to treat.

Financial Wellness Takes

A Back Seat

Financial Wellness Takes A Back Seat

Financial Wellness Investment Trend

- Investing more

- Investing same

- Investing less

In 2023, economic uncertainty and inflation concerns made financial wellness a top priority. However, with the stabilization of the broader economic climate in 2024, companies are reevaluating their approach:

-

The proportion of respondents who report an increase in their investment in financial wellness programs has significantly declined, from 65% in 2023 to just 30% in 2024.

-

Conversely, the percentage of companies maintaining their current level of investment has nearly doubled, rising from 29% in 2023 to 57% in 2024.

-

There's a marked increase in the number of companies reducing their investment, which has more than doubled from 6% in 2023 to 14% in 2024.

While financial well-being remains a valued aspect of employee wellness programs, there's less urgency to expand such initiatives. Some organizations may believe that resources offered by 401k and other financial wellness providers adequately address current needs. Consequently, organizations are redirecting their attention to other issues, like escalating healthcare costs, which remain pressing even as the overall economic situation improves.

Increased Flexibility In Wellness Journeys

Increased Flexibility In Wellness Journeys

Employers are increasingly recognizing the importance of providing flexibility in employees' wellness journeys:

-

Lifestyle spending accounts (LSAs): LSAs enable employees to allocate wellness funds according to their unique needs and preferences. In 2024, the majority of respondents (52%) plan to increase their investments in LSAs, up from 47% the previous year. Only 9% report a decrease in LSA investments, a drop from 13% in 2023.

-

Reimbursements: In 2023, 17% of respondents reporting increased investments in gym membership reimbursements. In 2024, 28% plan to boost their funding in reimbursements, broadening the scope to other wellness-related expenses like fitness equipment, mental health services, or nutrition counseling.

-

Flexibility and customizability: When selecting wellness benefits vendors, flexibility and customizability emerged as the second most popular criteria, with 59% of respondents choosing these in their top three. This highlights the importance of adaptable benefits for a diverse workforce with evolving needs.

These trends reflect a shift towards personalization and employee autonomy in wellness offerings, acknowledging that a one-size-fits-all approach falls short of meeting diverse needs. Such tailored solutions can foster inclusivity, improve well-being, and boost engagement.

Decision Influencers

Respondents were also asked how certain criteria influenced their employee benefits decisions. The escalating cost of benefits is the most significant influencer, causing organizations to tread cautiously as they strengthen their benefits packages.

Vendor Criteria

In addition to exploring areas of investment and influencing factors, respondents were asked what criteria had the greatest impact on vendor selection. Pricing, flexibility, and customizability emerged as key determinants, underscoring the current focus on cost-efficiency and tailored solutions for employee wellness benefits.

Pricing has become increasingly critical, with 89% of respondents considering it a top three criterion for selecting wellness benefits vendors. This is a 16-percentage point increase from last year, highlighting a heightened cost-consciousness among organizations driven by the rising costs of benefits and continued economic uncertainty.

Flexibility and customizability maintain importance, ranking second at 59%. Organizations planning to increase their investment in wellness benefits place a higher emphasis on flexibility (74%), compared to those maintaining their current level of investment (49%). This suggests that as companies commit more resources to wellness, they seek solutions that can be tailored to their specific needs.

Percentage Of Employers Choosing Flexibility & Customizability As Top Three Criteria

Customer Service is also gaining prominence in the vendor selection process alongside pricing. In 2023, 45% of respondents ranked customer service among their top three criteria, a figure that has risen to 50% this year, reflecting a growing recognition of its importance in ensuring effective and responsive wellness program implementation.

Reporting and measurement have decreased in priority, now valued by less than half (41%) of respondents. This may reflect the challenges in measuring the ROI of wellness benefits, along with the shift towards more qualitative assessments of effectiveness.

Innovation and technology have experienced a drastic drop, from 54% to 29%. While technological advancements continue to improve wellness offerings, the focus has shifted to how well these innovations deliver tangible results and improve customer experience. A sleek app or modern technology is no longer sufficient; efficacy and user experience are paramount.

Accessibility and inclusivity (22%) are emerging as important factors to cater to a diverse workforce.

Domain expertise (12%) and customer testimonials (0%) remain the least popular criteria.

Overall, the data reflects a pragmatic approach to vendor selection, focusing on cost-effectiveness, practical functionality, and the ability to meet diverse needs.

Best Practices For Wellness Programs

Finally, the survey asked respondents how often their clients employ six best practices that can optimize their wellness programs. Brokers were asked whether most of their clients, some of their clients, or few to none of their clients engaged in the associated practices. This section outlines how organizations can effectively implement these practices into their wellness programs.

Conclusion

Wellable’s 2024 Employee Wellness Industry Trends Report highlights an ongoing evolution in employee wellness, shifting from traditional physical health-focused programs to more holistic, flexible, and personalized solutions. This approach expands the scope of health, addresses broader employee needs, and promotes inclusivity in wellness journeys. Organizations are increasingly focused on the proactive management of high-cost chronic conditions to mitigate rising healthcare costs. Amidst the complexities of return-to-office strategies, mental health remains a central focus, and there’s a growing adoption of adaptable benefits that can be integrated into various work environments.

This report offers critical insights for HR leaders and organizations, highlighting the importance of wellness programs that are holistic, cost-effective, and adaptable, contributing to healthy, productive, and engaged workforces.

Explore The Data

When available, the report showcased seven years of historical data. The gradual year-over-year trends provide useful context for the drastic changes brought on by the pandemic and the following economic uncertainty.

Investment Trends

2024 Investment Trends

Historical Comparison

- Investing less

- Investing same

- Investing more

Decision Influencers

2024 Influencers

Historical Comparison

- Minimally influenced

- Somewhat influenced

- Significantly influenced

Vendor Evaluation

Historical Comparison

- 2018

- 2019

- 2020

- 2021

- 2022

- 2023

- 2024

Appendix

Participant Profile

Respondent Locations

Average Client Size

Broker Years of Experience

Survey Questions

- Where are you based?

- How many years of experience do you have working in employee benefits or wellness?

- What’s your average client size?

- How much are your clients investing in employee wellness compared to the previous year?

- How much are your clients investing in the benefits listed below compared to the previous year?

- How much are your clients’ decisions influenced by the factors listed below?

- What are your top criteria when evaluating wellness vendors (choose top 3)?

- How many of your clients engage in the activities listed below?