Executive Summary

In 2026, organizations are navigating a complex landscape defined by healthcare inflation, widespread burnout, and growing employee demand for flexible, personalized health and well-being support. These pressures are pushing leaders to refine their benefits approach to strike a careful balance between delivering meaningful value to employees and maintaining cost-effective, sustainable offerings. Success will depend on the strength of individual benefits, and on how they interact with adjacent policies—like paid time off, flexible scheduling, and care access—to form a cohesive and resilient well-being strategy.

This year’s Employee Well-Being Industry Trends Report is designed to guide organizations in making well-informed decisions regarding employee wellness benefits. This report is distinctly shaped by data collected directly from health insurance brokers, who represent thousands of employers and millions of employees. It offers a detailed analysis of investment trends, key factors influencing decision-making, and criteria used by organizations to evaluate wellness vendors. This year’s edition features dedicated sections on artificial intelligence (AI) adoption, top financial wellness solutions, and engagement barriers in mental health support. These timely insights are particularly crucial for HR leaders as they plan and implement wellness initiatives for the year ahead.

Employee Wellness and Benefits Investment Trends

This survey identified 23 of the most popular wellness solutions that employers are investing in throughout 2026. Respondents were asked whether they expect employers to invest less, the same, or more in each benefit this year.

Overall, wellness investments are holding steady, with 60% of respondents reporting increased spending on employee benefits, indicating a continued focus on employee well-being support, even amid rising healthcare costs and growing pressure to demonstrate return on investments. Only 4% expect a decrease, while 36% anticipate maintaining current levels.

Mental health and well-being remains the top investment category, with 74% of respondents expecting growth, followed closely by preventive health resources (72%) and lifestyle support (52%). While enthusiasm for physical fitness offerings has softened slightly, areas like physician engagement, disease management, and weight management are seeing year-over-year gains. At the same time, some previously popular offerings, such as gym reimbursements, Lifestyle Spending Accounts (LSAs), and mindfulness offerings, have seen modest declines.

Together, these shifts suggest that while overall investment remains strong, employers are refining their strategies and focusing on accessibility, clinical impact, and measurable outcomes to deliver more personalized and effective wellness support.

Investment Trend Across All Benefits

-

Investing Less

-

Investing Same

-

Investing More

Rising Stars

Percentage of Companies Investing More in 2026

- Mental Health Programs

- Disease Management

- Weight Management

- Stress Management & Resilience

- Physician Engagement

Organizations remain committed to high-impact areas like mental health programs, weight management, and preventive care, recognizing their value in improving both employee well-being and business outcomes. This year, there is an expected shift toward more clinically grounded, results-driven benefits that address chronic conditions and employee stress trends.

Employers are increasingly aligning investments with evolving needs, such as GLP-1 coverage, physician engagement, and disease management strategies. These shifts reflect a broader trend: designing benefits that are supportive as well as measurable, sustainable, and employee-informed.

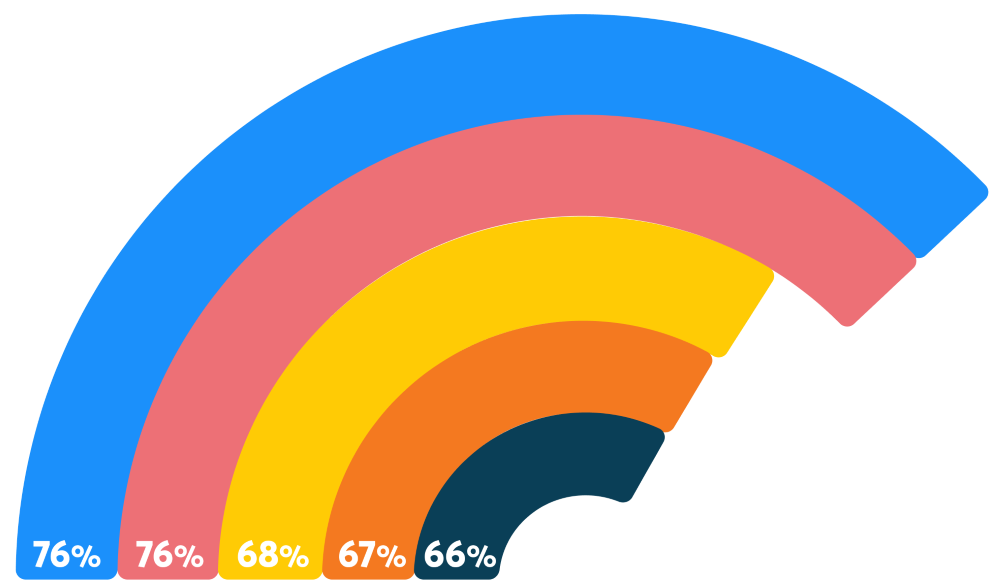

76%

of employers increasing investment in mental health

For the seventh year in a row, mental health resources remain a top investment priority, even with a 7% decline from last year. Despite this slight pullback, 76% of respondents still indicate increasing investments in mental health resources, signaling ongoing commitment to holistic employee well-being, including emotional resilience and burnout prevention.

After a year marked by layoffs, economic uncertainty, and societal division, mental health support remains a baseline expectation for today’s workforce. A majority of U.S. adults (54%) report feeling isolated, and 73% of employees say work-related mental health struggles are negatively impacting their performance, citing causes such as stress, burnout, and uncertainty about how AI may affect their roles.

Despite the clear need for continued support, some respondents indicated that rising costs and budget constraints are leading employers to scale back mental health benefits, leading them to focus on more cost-effective solutions. These include enhancing existing Employee Assistance Programs (EAPs) through tiered upgrades, switching to standalone EAPs with greater customizability, or enhancing communication of available offerings.

As mental health strategies continue to evolve, employers are also increasingly exploring holistic approaches through solutions like manager training, flexible work design, and resilience or stress management solutions.

Employers are continuing to prioritize weight management benefits, with 76% of respondents indicating an increase in investment, slightly up from 75% last year. This sustained investment is largely driven by the popularity of GLP-1 medications, which are transforming how organizations approach weight management and chronic condition support.

Today, 55% of employers cover GLP-1 drugs for diabetes, while 36% cover them for both diabetes and weight loss. However, concerns around long-term efficacy, equitable access, and escalating costs remain top of mind.

As fitness offerings are declining compared to last year, this may suggest that employers are not consistently integrating lifestyle benefits with weight management medications.

In 2026, 33% are investing less in on-site fitness classes (up from 24% in 2025), and 24% are reducing investment in on-demand fitness options (up from 16% last year).

However, recent World Health Organization guidelines on GLP-1 therapies for treating obesity highlight the potential value of pairing medication with behavioral interventions—such as structured diets and exercise programs—to improve long-term health outcomes. Though the evidence is still emerging, incorporating lifestyle support alongside GLP-1s could offer a more comprehensive approach to long-term weight management.

Percentage of Employers Investing More in Physician Engagement

Employers are doubling down on physician engagement, with 68% of respondents anticipating larger investments in 2026, up from 58% in 2025. By promoting early detection and preventive care, employers can help workers reduce the risk of developing costly chronic conditions, like heard disease or type 2 diabetes, over time.

This renewed focus on physician engagement includes increasing access to and coverage for annual physicals, age-based screenings, and cancer prevention exams. Many are also incentivizing participation in clinical events through monetary rewards to improve completion rates.

At the same time, there is a growing interest in health literacy tools and education campaigns to help employees better understand, access, and use available resources, supporting individual well-being and long-term cost savings.

Clients are increasingly investing in preventive health through education and health literacy, empowering employees to understand their health, make informed decisions, and become their own health advocates.

- Survey ParticipantPercentage of Employers Investing More in Disease Management

Up from 58% last year, 67% of respondents indicate increasing investment in disease management for conditions like diabetes. Much of this momentum is driven by the rising use of GLP-1 medications, which are increasingly being leveraged to manage diabetes and obesity.

With over half of employers currently covering GLP-1s for diabetes, these medications are becoming a central piece of chronic condition care. This trend is well-founded: 90% of the nation’s $4.9 trillion in annual healthcare costs are attributed to chronic and mental health conditions—including diabetes, heart disease, and cancer.

According to Harvard research, 58% of U.S. employees report having a chronic health condition, and many struggle to manage their care while balancing work responsibilities. More than two-thirds have delayed or skipped medical appointments to avoid disrupting their workday, and nearly half (49%) say they feel unable to take time off to address their condition.

While investments in treatments like GLP-1s remain important, a more holistic approach that includes flexible work schedules and adequate paid time off can better empower employees to manage their health without compromising their job performance.

66%

of employers increasing investment in stress management and resilience

Stress management and resilience resources remain a core component of employers’ mental health strategies, with 66% of respondents reporting plans to invest more in 2026, just slightly down from 70% in 2025. This continued focus reflects the urgent need to address widespread burnout: 66% of U.S. employees report experiencing burnout, driven by factors like unmanageable workloads (24%), lack of resources (24%), and economic uncertainty (20%).

In response, many employers are embedding stress management into broader mental health initiatives, including EAPs, mindfulness tools, and educational webinars. These efforts signal a sustained commitment to equipping employees with the tools they need to build resilience and stay engaged in an increasingly demanding work environment.

Falling Giants

Several long-standing wellness offerings are experiencing a steady decline in employer investment, signaling a shift in how organizations prioritize and deliver health-related benefits. As workplaces continue to evolve with hybrid schedules, dispersed teams, and rising demand for personalized support, initiatives that once served as wellness cornerstones, like biometric screenings, are losing traction. Rather than relying on traditional or location-dependent initiatives, many employers are reallocating resources toward more flexible, individualized, and technology-enabled solutions. This transition reflects a broader movement toward year-round engagement, scalable programming, and benefits that better align with the diverse needs of today’s workforce.

Percentage of Companies Investing Less in 2026

Percentage of Employers Investing Less in Fitness Classes

On-site fitness classes continue to lose traction, with 33% of respondents indicating less investment in 2026, up from 24% last year. While some companies still offer these classes to encourage office presence, shifting work models make participation harder to coordinate. Globally, work styles are varied with 26% of employees fully remote, 52% following a hybrid schedule, and 22% in-person full time, complicating efforts to host consistent, in-person wellness experiences. Though on-demand fitness classes offer greater flexibility, they too are seeing reduced investment (24% investing less, up from 15%), suggesting they may fall short on engagement and team connection. Still, when offered in tandem, on-site and on-demand options can provide a more inclusive experience, balancing convenience for remote and hybrid workers with opportunities for in-person camaraderie and culture-building.

As organizations rethink their physical wellness strategies, many are turning to more inclusive or personalized options, such as gym reimbursements or LSAs, that support a broader range of employee needs without relying on shared schedules or office presence.

Biometric Screenings Investment Trend

-

Investing More

-

Investing Same

-

Investing Less

-

No Answer

Biometric screenings are seeing a decline, with 33% of respondents indicating less investment in 2026 (up from 25% last year), while only 24% indicate increasing investment. This trend suggests that biometric screenings, especially those offered through third-party vendors, are falling out of favor as employers shift toward more integrated and clinically aligned preventive strategies.

As physician engagement rises, organizations are beginning to route screenings and risk detection through primary care providers instead. This shift reflects a broader movement toward care continuity, medical accuracy, and more personalized employee health engagement.

Other potential contributors to the dip in investment could include concerns around the screening’s long-term effectiveness, high administrative costs, and limited impact on employee behavior. As research remains varied on the effectiveness of biometric screenings, holistic, ongoing wellness initiatives potentially pose a better investment, offering sustained support rather than one-time metrics.

Clients are valuing relationships with primary care providers a little more this year and moving away from third-party vendors offering onsite biometric screenings.

- Survey Participant

of employers decreasing investment in tobacco & smoking cessation

Thirty-one percent of respondents report plans to decrease investment in tobacco cessation programs in 2026, up four percentage points from the previous year. This marks a continued decline in prioritization, despite the well-documented health risks associated with tobacco use. As cessation programs see reduced funding, some organizations are exploring alternative strategies to drive participation, such as implementing tobacco surcharges within benefits plans. These financial incentives are designed to motivate individuals to engage in available resources and quit smoking, but they also raise concerns around equity, privacy, and long-term effectiveness. In many cases, traditional cessation offerings struggle with low engagement, limited personalization, and stigma-related barriers. Still, smoking remains the leading cause of preventable death worldwide. Employers aiming to modernize cessation support might consider behavioral coaching, digital tools, or embedding cessation into larger wellness efforts like mental health support and stress reduction programming.

of employers decreasing investment in health fairs

Investment in health fairs is experiencing a nuanced shift in 2026. Although they are one of the less prioritized wellness offerings, the data shows a mixed pattern in how employers will be approaching them. Twenty-four percent of respondents indicate reduction in investment this year, a slight increase from 22% in 2025, suggesting that there may be a pull back on large, event-based wellness initiatives.

At the same time, interest in enhancing health fair offerings is growing among a segment of respondents. Thirty two percent expect increased investments in 2026, up from 26% in 2025—a significant year over year jump. This increase may reflect renewed focus on tailored, in person experiences as part of broader wellness culture building efforts, particularly for organizations navigating hybrid work models. Many employers are also making more benefits changes than usual this year to manage costs, and they’re using health fairs as a strategic way to communicate those updates in a supportive and engaging format. Still, the overall trend points toward a gradual evolution rather than a strong resurgence. As more companies embrace digital benefits navigation tools and year round wellness strategies, traditional health fairs may play a smaller role within the employee experience. While not disappearing, they are becoming just one component of a more diversified and continuous approach to wellness engagement.

Barriers to Engaging Employees in Mental Health Programs

Despite growing investment in workplace mental health, many employees remain disconnected from available support. The most common barrier respondents cited is simple but significant: awareness. Only half of today’s workforce knows how to access care through their employer benefit plans, and programs that are limited in scope (like EAPs offering only a few counseling sessions) often fail to generate engagement. Without consistent communication, even well-intentioned offerings fall flat.

Cost and access are also major obstacles. Rising medical renewals are challenging for HR budgets, limiting the ability to add or expand services. Meanwhile, long wait times for appointments (sometimes up to six months), combined with providers not accepting insurance, weak networks inhibiting virtual support, or rural access challenges, make proper care difficult to obtain. These hurdles are compounded when programs lack specialized support for key groups like parents or teens.

Finally, cultural and structural issues pose their own set of challenges. Stigma, concerns around confidentiality, and a general lack of trust deter employees from engaging. Internally, respondents cited roadblocks such as red tape, union barriers that prohibit new vendors, and insufficient leadership promotion as inhibitors to progress. To improve utilization, employers need comprehensive, accessible, and inclusive benefits, and stronger, more targeted communication accompanied by visible support from leadership to ensure stronger engagement and equitable care access.

AI-Powered Wellness Solutions: Emerging, but Not Yet Mainstream

Adoption of AI-powered wellness solutions is growing, but cautiously. Fifty-two percent of respondents indicated that, in 2025, their clients either had not invested in AI wellness tools, or they were uncertain whether any investment had been made. Over one-third (34%) of respondents indicated clients had invested in limited areas, such as mental health, fitness tracking tools, or personalized financial guidance. Only 14% said clients leveraged AI across multiple wellness domains, suggesting that most organizations were still in the exploration phase last year.

In 2026 however, there is a clear push for more investment as 30% of respondents are actively recommending AI-powered wellness tools to employers, and a substantial 65% say they are considering doing so in the near future.

This growing interest suggests that industry professionals are increasingly recognizing AI’s potential to deliver scalable, personalized support, especially as solutions become more refined and accessible. However, many employers are still hesitant about AI implementation due to aspects like data privacy and security concerns, lack of trust in AI-driven recommendations, and compliance or regulatory uncertainty.

As the majority of consultants and brokers warm to these technologies and early-adopter employers see results, broader adoption may follow, particularly in areas where AI enhances the user experience, reduces administrative burden, or delivers actionable health insights. For now, AI is a rising trend to watch, with untapped potential still waiting to be realized and a variety of perceived risks employers will have to weigh against its benefits.

Employers’ Perceived Risks with Adopting AI-Powered Wellness Solutions

Financial Wellness Is a Clear Priority

Financial Wellness Investment Trend

Financial wellness is emerging as a key area of focus in 2026. A majority (55%) of respondents indicate an increase in spending in this category, up 11% from the previous year. This rise points to a growing commitment to employees' financial stability as part of a more holistic approach to well-being.

Respondents highlight financial planning tools or coaching (through one-on-one or digital platforms), personal finance education, and reimbursement programs (e.g., commuting or gym memberships) as top solutions. Many organizations are expanding their investment to support employees across all life stages—from student loan assistance to increased retirement contributions—recognizing that financial stress varies widely based on age, role, and income level.

This uptick is likely in response to the mounting financial stress today’s workforce is facing. Sixty-six percent of employees feel stressed about their financial situation, and 76% believe the cost of living is rising faster than their income. Over half (57%) are living paycheck to paycheck, and just 25% say they are on track for retirement. These numbers highlight the urgency of financial wellness as a retention tool and a pillar of sustainable workforce well-being.

Decision Influencers

Respondents were asked how various factors influenced their employee well-being benefits decisions in 2026. While cost pressures remain the dominant force, employers are still working to design competitive well-being strategies that support workforce resilience, mental health, financial stability, and a positive employee experience. The following sections outline how each influencer is shaping employer choices in the year ahead.

Benefits Costs

Benefits Plans

Conditions

Employee Interests

Benefits

Managing rising benefits costs remains the dominant factor influencing employer decisions around well-being benefits in 2026, with 93% of respondents reporting it as significantly influential. Mercer projects that total health benefit cost per employee will rise 6.5% in 2026, the highest increase in 15 years, even after employers take steps to control costs. Without interventions, it’s estimated that annual increases would approach 9%, reinforcing that financial strain is strongly shaping benefits decisions.

Cost pressures are intensifying across multiple areas of health spending. According to HUB International, prescription drug costs are expected to grow 10% to 12% in 2026, driven by specialty medications, expanded use of GLP-1 drugs, and continued innovation in high-cost therapies, making pharmacy inflation one of the most volatile elements of healthcare trend.

Given these escalating costs, employers should consider expanding their use of preventive and holistic well-being programs as a cost-management strategy. Investing in resources such as stress-management tools, digital behavior-change platforms, or chronic-condition support can help reduce high-cost utilization over time while strengthening employee resilience. By emphasizing cost-effective, high-impact well-being initiatives, organizations can help manage rising health expenses without diminishing the value employees expect from their benefits package.

Creating a competitive benefits plan remains highly influential, with 70% of respondents citing it as a key factor in shaping well-being strategies. Even as cost pressures intensify, employers recognize that wellness programs are essential to attracting and retaining talent. Forbes reports that 90% of workers value employee well-being as much as compensation, with nearly half willing to pass on a 10% pay bump in exchange for enhanced wellness benefits.

To remain competitive, employers should highlight the well-being initiatives that enhance the perceived value of their total rewards package, using them as a strategic differentiator in recruiting and retention efforts. For example, offering robust mental health benefits, such as expanded virtual counseling access or no-cost therapy sessions, can signal a strong commitment to workforce well-being and set an employer apart in a crowded labor market.

Aligning well-being benefits with employee interests remains a significant decision driver, with 70% of respondents noting this factor influences their 2026 strategy. Organizations that consistently gather and act on employee feedback are more effective at pinpointing employee priorities, uncovering gaps, and refining or expanding well-being programs accordingly.

To better align benefits with workforce expectations, employers should use structured feedback to guide ongoing improvements to their well-being strategy. Prioritizing the programs that meaningfully support employees’ day-to-day lives can help ensure benefits are relevant and fully utilized.

Percentage of Employers Significantly Influenced by the Need to Align Benefits with Employee Interests

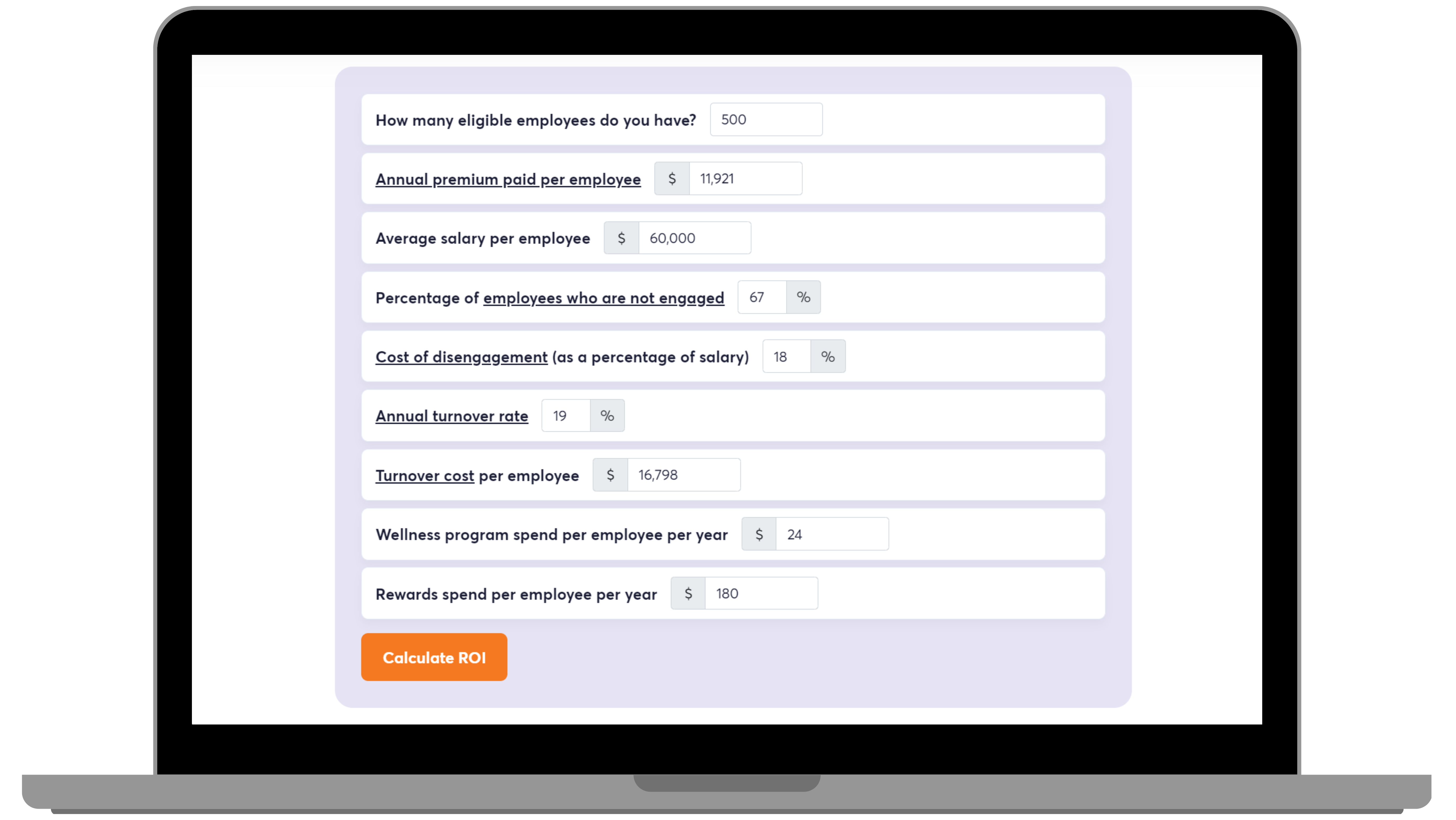

Measuring the impact of well-being benefits remains a priority for employers in 2026, with 70% of respondents reporting that ROI is significantly shaping their decisions. As organizations confront rising healthcare costs, leaders are looking for clearer evidence that well-being investments contribute to healthier, more resilient, and more engaged teams.

With the continued investment in areas like mental health, stress management, and resilience, our research highlights the growing emphasis on value on investment (VOI): an approach that measures a broader set of outcomes, expanding on traditional ROI metrics (e.g., healthcare cost savings) to include areas like engagement, morale, retention, and productivity. These indicators offer a more complete picture of how well-being programs contribute to organizational performance.

Macroeconomic uncertainty remains a significant factor for 47% of employers shaping their well-being strategies in 2026. Inflationary pressure and broader economic volatility are prompting organizations to be more deliberate about which well-being investments offer meaningful stability and support.

Percentage of Employers Significantly Influenced by Macroeconomic Conditions

The growing impact of burnout on the workforce is adding to these pressures. A recent analysis cited by Forbes found that 82% of employees are at risk of burnout, with estimated costs ranging from $4,000 to over $20,000 per employee each year due to productivity loss and turnover.

Given the financial risks associated with burnout, especially during periods of economic volatility, employers should consider strengthening preventive well-being initiatives that support resilience, reduce stress, and help stabilize productivity. Focusing on cost-effective programs that address emotional, financial, and mental well-being can serve as a proactive hedge against the heightened pressures created by uncertain macroeconomic conditions.

Uncertainty around healthcare legislation continues to influence employer decision-making, with 35% of respondents noting this factor shapes their 2026 well-being strategies. Even without major federal overhauls, ongoing adjustments to health plan rules, such as evolving transparency and reporting requirements, create ambiguity that makes long-term planning challenging for employers.

To navigate this uncertainty, employers should stay informed on upcoming regulatory changes and review their well-being plans regularly so they can adjust quickly if new rules affect eligibility, reporting requirements, or communication needs. Keeping up with federal agency updates can help organizations stay compliant without disrupting the employee experience.

Influence of Uncertainty Regarding Healthcare Legislation

Helpful Resources for Staying Informed on Regulatory Updates:

- CMS Transparency Requirements: https://www.cms.gov/priorities/healthplan-price-transparency/health-plan-price-transparency

- DOL Employee Benefits Security Administration Updates: https://www.dol.gov/agencies/ebsa

Adapting to new software platforms is a meaningful consideration for 29% of employers in shaping their well-being decisions in 2026. As organizations evaluate benefits administration systems, well-being platforms, HRIS tools, and emerging AI-enabled solutions, many are weighing how technology complexity affects the employee experience and HR operations. Concerns about adoption, ease of use, and integration are influencing which well-being technologies employers are willing to introduce into an already crowded digital environment.

To address this challenge, employers should prioritize well-being technology that is simple, intuitive, and minimally disruptive to employees’ existing workflows. Employers should consider platforms that integrate cleanly with current systems to strengthen engagement and ensure well-being initiatives deliver their intended impact.

Only 11% of employers say DEI initiatives significantly influence their 2026 well-being decisions, reflecting a broader national shift in how organizations approach DEI. Many companies rolled back DEI programs in 2025, driven by political climate changes, economic pressures, and challenges measuring ROI.

Although there are still many companies maintaining or modestly increasing DEI budgets, a meaningful segment is scaling back, with some redirecting funds to general operations, AI initiatives, or other business priorities. These trends suggest a reevaluation of DEI as a standalone investment heading into 2026.

Rather than relying on approvals and budgeting for standalone programs, organizations can embed inclusion principles into well-being initiatives, communication practices, and overall benefits design to ensure all employees feel supported, regardless of budget shifts or organizational restructuring.

Percentage of Employers Significantly Influenced by the Need to Implementing Internal DEI Initiatives/Programs

Vendor Criteria

This year, 37% of respondents identified pricing as their top priority in vendor selection, clearly reflecting the growing demand for cost-efficiency amid projected spikes in healthcare spending and double-digit prescription drug inflation. In today’s market, employers are looking for measurable value at sustainable price points.

That said, other priorities are beginning to shift. Flexibility and customizability ranked second, with 17% of respondents selecting it as their top criterion. This suggests that organizations are seeking solutions that can adapt to the unique needs of their workforce.

Notably, accessibility and inclusivity saw a meaningful rise, with 13% of respondents naming it their top priority, up significantly from just 4% in 2025. This highlights a growing recognition that equitable wellness offerings are essential for meeting the needs of diverse employee populations. Innovation and technology also experienced a modest increase, with 8% of respondents selecting it as their top criterion. This 4% uptick from last year is likely driven by the growing interest in how AI and emerging technologies can enhance personalization, engagement, and delivery of wellness programs.

of brokers selected pricing as the top priority for vendor selection

of brokers selected flexibility and customizability as the top priority for vendor selection

of brokers selected accessibility and inclusivity as the top priority for vendor selection

of brokers selected customer service as the top priority for vendor selection

of brokers selected innovation and technology as the top priority for vendor selection

of brokers selected customer testimonials as the top priority for vendor selection

of brokers selected domain expertise as the top priority for vendor selection

of brokers selected reporting and measurement as the top priority for vendor selection

Best Practices for Wellness Programs

Finally, the survey asked respondents how often their clients employ six best practices that can optimize their wellness programs. Brokers were asked whether most of their clients, some of their clients, or few to none of their clients engaged in the associated practices. This section outlines the results along with how organizations can effectively implement these practices into their wellness programs.

How Many of Your Clients Invest in These Programs?

Investing in wellness program rewards and incentives remains one of the most widely adopted strategies. This year, 88% of respondents report that some or all of their clients rely on incentives to boost engagement, emphasizing their continued importance in driving participation. Research shows that rewards effectively reinforce behavior change: when people experience positive outcomes, such as external incentives like points or prizes, they are more likely to repeat the behavior and develop healthy habits.

A successful wellness rewards program supports holistic well-being by driving sustained engagement. Follow these steps to build a program that aligns with your culture and employee needs:

- Assess employee priorities: Start with pulse surveys or focus groups to understand what motivates your team and what challenges they face. Tailor rewards to support different wellness dimensions (e.g., yoga mat for physical wellness, extra PTO for emotional well-being, gift cards to support employees financially).

- Choose a structure: Decide whether to run a continuous program, time-based challenges (e.g., month-long step goals), or a blended approach which can help maintain engagement while offering moments of novelty.

- Set clear, inclusive goals: Define specific, measurable behaviors to reward, such as attending a mindfulness webinar, logging daily steps, or completing preventive screenings. Ensure goals are flexible so employees of all wellness levels can participate.

- Use a point-based or tiered system: Assign points based on the time and effort required for each activity. For example, 200 points for a webinar or 600 for completing a 30-day fitness challenge. Offer rewards tiers to encourage ongoing participation.

- Monitor and adjust: Track engagement, reward redemption, and feedback to evaluate success. Use these insights to evolve the program, update incentives, or improve accessibility.

Importantly, this year’s growing emphasis on preventive care and physician engagement along with investments into mental health, stress management, and financial wellness programs (which saw an 11% increase from last year) signals a shift toward holistic well-being that integrates clinically grounded initiatives with lifestyle-based offerings.

A lifestyle-based approach focuses on improving daily habits that support long-term health and quality of life. Consider these strategies to build a more holistic and inclusive program:

- Broaden the definition of preventive care: Support proactive health habits by incorporating fitness challenges, health literacy campaigns, and nutrition support in tandem with encouraging regular physician engagement.

- Prioritize employee needs in today’s economic climate: Offer financial education workshops, expand access to retirement planning tools, and consider stipends or reimbursement benefits that reduce day-to-day financial stress.

- Strengthen mental health support: Expand access to therapy or coaching, offer mental health days, integrate mindfulness apps or sessions, and host webinars focused on emotional resilience and stress management.

- Build flexibility and customization into programs: Allow employees to choose how they participate, earning points or rewards through physical activity, mindfulness exercises, volunteering, or attending educational sessions.

- Promote a culture of wellness through everyday practices: Encourage work-life balance with flexible schedules, protect PTO as time for true rest, and normalize daily breaks for movement, reflection, or recovery.

Technology has become an essential pillar of modern wellness strategies with 75% of respondents reporting that some or all of their clients have integrated wearable technology into wellness programs.

Spending on fitness wearables surged 88% in 2025, with smart rings emerging as a major driver of that growth. Wearables provide real-time feedback, which fosters personal accountability and empowers users to monitor their progress with minimal effort. When integrated into wellness programs, they also introduce elements of gamification, turning health goals into challenges, rewards, and team competitions that make participation more engaging.

Wellness platforms also continue to evolve, serving as centralized hubs for content, challenges, communication, and analytics. When paired with wearables, they offer a seamless experience that encourage employees to take charge of their well-being and give organizations a clearer view of program effectiveness.

To integrate these technologies into wellness programs, consider the following guidelines:

-

Make wearables accessible: Consider offering subsidies, reimbursements, or device lending libraries to reduce cost barriers. Accessibility drives equity and boosts participation.

-

Prioritize platforms with strong integrations: Use wellness platforms that sync easily with popular wearables (e.g., smart rings, watches, fitness trackers) or apps like Apple Health to enable real-time tracking and goal setting.

-

Support the full spectrum of well-being: Ensure all program technology supports not just physical health, but also emotional, financial, and social well-being through diverse activities and resources.

-

Communicate clearly and protect privacy: Be transparent about how data will be used and stored. Reassuring employees builds trust and increases engagement.

-

Use data for personalization: Leverage analytics to identify participation trends and tailor content, challenges, and rewards to meet evolving employee needs.

Leadership involvement remains one of the most powerful, yet underused, drivers of wellness program success. When leaders participate in wellness initiatives, it signals organizational commitment, encourages broader engagement, and helps embed health and well-being into company culture. It also tends to unlock stronger funding, visibility, and support across departments.

This year, 72% of respondents report that some or all of their clients have leadership involvement in their wellness programs, indicating widespread understanding that this low-effort, high-impact strategy can significantly improve program uptake and outcomes.

Effective leadership involvement looks like:

-

Regular participation: Normalize wellness by having leaders actively join challenges, workshops, or team well-being breaks.

-

Communication leadership: Involve leaders in launching wellness initiatives and speaking to their importance in company-wide communications.

-

Visible support at events: Ask leaders to kick off wellness events and participate alongside employees.

-

Authentic storytelling: Encourage leaders to share their own wellness journeys, whether small wins or personal challenges, to humanize the effort and boost relatability.

-

Resource backing: Ensure leadership helps secure time, budget, and policy support for programs to reinforce that employee well-being is a business priority.

Only 18% of respondents indicate that most of their clients are measuring the return on investment (ROI) of wellness programs while almost half (42%) report few of their clients do. Traditional ROI metrics often focus narrowly on reductions in healthcare costs, which can be challenging to uncover as this outcome is influenced by numerous variables beyond the wellness program. This limited scope can overlook the broader value these initiatives deliver across the organization.

To capture a more complete picture, many employers are turning to Value on Investment (VOI) as a strategic complement to ROI. VOI broadens the evaluation lens to include both quantitative and qualitative outcomes, such as employee engagement, morale, retention, productivity, and overall well-being. These factors may not translate directly into immediate cost savings but have a significant impact on organizational performance over time.

By assessing both ROI and VOI, organizations can better understand the full impact of their wellness programs, balancing financial accountability with long-term value creation and enhanced employee experience.

Discover Wellable’s ROI & VOI Calculator

Access Now

Despite its critical role in shaping effective wellness programs, only 17% of respondents say most of their clients actively collect employee feedback through surveys. This suggests that while a majority (60%) of respondents indicate an increase in wellness program investment, many organizations are still making decisions without fully understanding what their employees want or need.

As wellness programs become more complex, skipping this step increases the risk of misaligned benefits, underused resources, and disengagement. In fact, benefits satisfaction has declined to 61%, down from 66% in 2024, according to a recent report.

While cost continues to be a primary driver in wellness decisions, often outweighing employee preferences, simple tools like quarterly polls, pulse checks, or interest surveys can surface hidden barriers, highlight new opportunities, and reinforce that employee input is valued.

Employee Wellness Interest Survey Template

To optimize the effectiveness of feedback mechanisms, consider the following:

-

Move from periodic to continuous listening: Layer ongoing check-ins on top of one-time surveys to stay attuned to shifting needs and real-time sentiment.

-

Keep it short and targeted: Ask fewer, more meaningful questions tailored to specific topics like stress, workload, or program satisfaction to avoid fatigue and increase response quality.

-

Use tech to capture and analyze feedback faster: Incorporate tools that use AI or built-in analytics to surface insights quickly, especially from open-text responses.

-

Diversify methods: Not everyone will engage through surveys. Use anonymous comment boxes, quick polls in meetings, or opt-in feedback moments after events to reach more employees.

-

Follow up with visible action: Communicate what surfaced in the feedback and what’s changing as a result. Even small shifts based on employee input can increase engagement and trust over time.

Conclusion

Wellable’s 2026 Employee Well-Being Industry Trends Report reveals a well-being landscape defined by strategic recalibration. Organizations are not retreating from wellness benefits but refining their strategies by pursuing high-impact, clinically grounded, and cost-effective solutions that respond to evolving employee needs and current economic drivers. Mental health, weight management, disease prevention, and financial well-being top the list of growing investment areas, with a clear emphasis on personalization, accessibility, and measurable outcomes.

As benefits budgets come under increased pressure, employers are moving beyond one-size-fits-all programming to build holistic, integrated experiences that support resilience and performance. AI-powered tools, lifestyle-based interventions, and physician engagement are gaining traction, while more traditional offerings like biometric screenings and fitness classes face continued decline. Success in this shifting environment will hinge on strategic alignment that ensures wellness investments are backed by leadership, driven by employee input, and embedded within a broader culture of wellness.

Explore The Data

When available, the report showcased seven years of historical data. The gradual year-over-year trends provide useful context for the drastic changes brought on by the pandemic and the following economic uncertainty.

2026 Investment Trends

Historical Comparison

2026 Influencers

Historical Comparison

2025

2026

Appendix

Average Client Size

Small

250 employees

Large

1,000+ employees

Medium

250 - 1,000 employees