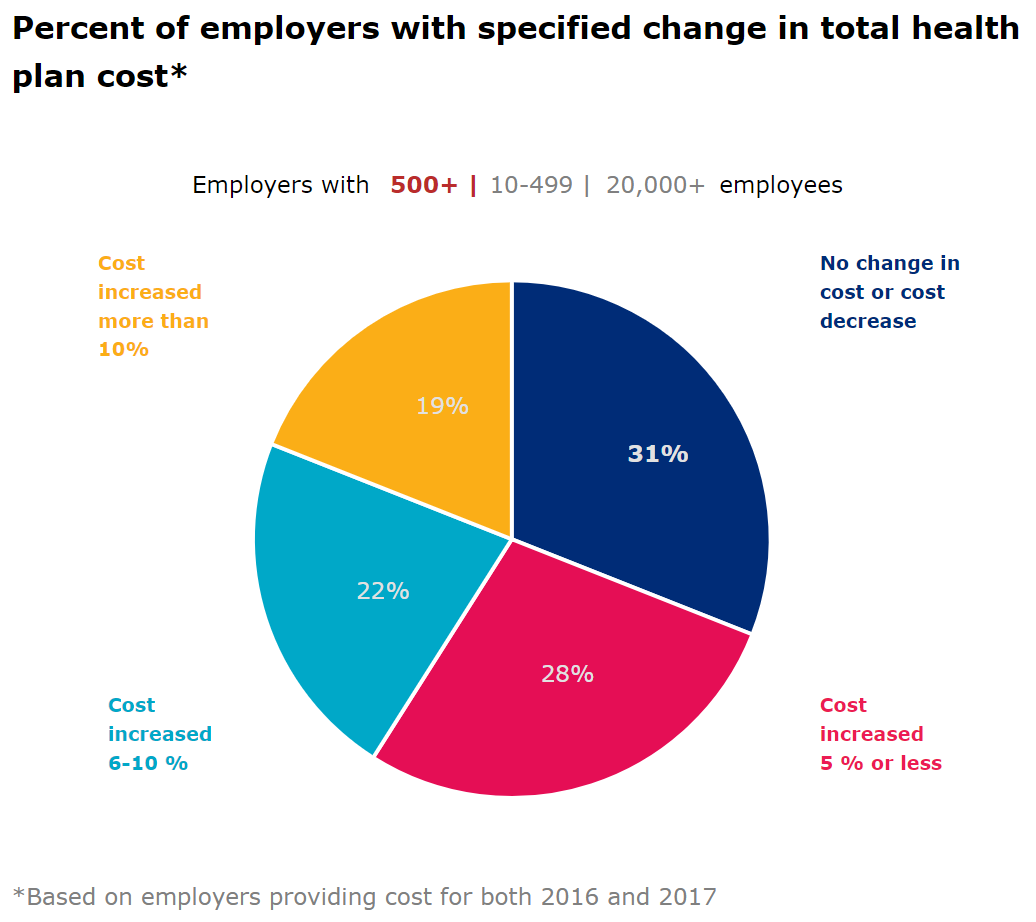

“Most small employers have faced increasing costs associated with their health plans, while suffering from a lack of leverage and resources to manage the costs.” This is the opening line in an article covering some of the findings from Mercer’s National Survey Of Employer-Sponsored Health Plans. Although employers across the board saw health plan costs rise for a variety of reasons in 2017, small employers (less than 500 employees) were especially vulnerable to cost effects, according to the national survey. Below is the raw data from the survey.

More than one-third of small employers saw more than a 10% increase in total health plan cost. When compared to employers with more than 500 employees, 19% of which experienced a similar increase, small employers are clearly facing a greater burden from rising medical expenses. The larger the employer the lower increase in total health plan costs, as only 11% of jumbo employers (20,000+ employees) experienced a 10% increase.

A number factors contributed to the cost increases, including expensive new treatment options and a rapidly aging population. A new cost driver is the slow rise of uninsured patients, which ticked up in 2017 and is likely to lead to providers shifting the costs of uncompensated care onto employer health plans. In the report, Mercer highlighted the importance of maintaining a vibrant workforce in order to counter the effects of rising costs associated with uninsured populations.

Small employers often do not have the financial or internal resources to manage benefit costs, and as a result, they are not able to launch programs that will help control their expenses. The rise of technology and solutions like Wellable have removed many of these barriers by providing affordable, high-impact solutions coupled with account management services. The result is a completely outsourced comprehensive employee wellness program that works within small employer budgets.