Lifestyle spending accounts are the latest employee engagement tool. They provide employees with both flexibility and autonomy while simultaneously allowing organizations to define the scope and remain committed to their values.

What Is A Lifestyle Spending Account?

A Lifestyle Spending Account (LSA) is an employer-provided flexible benefits account that supports diverse workforce needs. Employees are given a one-time or recurring stipend to pay for lifestyle and wellness-related products and services of their choice. This can include expenses like gym memberships, childcare, pet care, leisure activities, travel, and more.

The key feature of an LSA is its flexibility, allowing employees to choose how to best use their funds based on individual preferences. This approach empowers employees with a sense of autonomy and ownership and reflects a company’s commitment to supporting varied wellness journeys.

How Do Lifestyle Spending Accounts Work?

Employee stipends can usually be accessed in one of two ways, either through a virtual account that can be used on a marketplace or by submitting a claim for reimbursement. Funds can be used to cover any expenses related to the employee’s lifestyle choices, as long as those expenses fall within the defined parameters.

This type of account can be a great way for organizations to show their employees that they care about their well-being. At the same time, it gives employees the freedom and flexibility to make their own choices about how to improve their lives. These solutions can also be used to manage existing fringe benefits such as healthy meals, pet care expenses, and more.

Why Should Organizations Offer Lifestyle Spending Accounts?

Lifestyle Spending Accounts are increasing in popularity for their modern and flexible approach to supporting employee well-being. While LSAs present clear advantages, they also come with challenges that organizations must navigate.

Pros of Lifestyle Spending Accounts

- Flexibility and adaptability: LSAs surpass one-size-fits-all approaches by catering to the diverse, changing preferences of employees, ensuring that everyone’s needs are met.

- Autonomy and ownership: These accounts provide employees with the freedom to choose benefits that suit their unique lifestyles, fostering a sense of personal investment in their well-being. This can lead to more consistent use and effective lifestyle improvements.

- Increased value: When HR leaders try to address various wellness needs with multiple solutions, the costs can quickly add up. Uniting these under a single, comprehensive benefit solution not only eases administrative burdens but it can also boost its perceived value by as much as 51%.

- Talent attraction and retention: The customizable nature of LSAs make it a widely appealing wellness benefit. Offering them can increase the company’s desirability, aiding in recruitment and retention.

Cons of Lifestyle Spending Accounts

- Cost considerations: LSAs often require a substantial budget to make them valuable and worthwhile, as lifestyle products and services tend to be costly. Since LSAs are employer-funded, the costs of funds for each employee’s account can be a significant addition to the annual benefits budget.

- Tax implications: LSAs are taxable for employees, unlike HSAs, HRAs, or FSAs. This tax burden might deter participation, despite the account’s other benefits.

- Potential misuse: Without explicit guidelines, employees may allocate LSA funds to unintended or non-qualifying expenses.

What Can An LSA Be Used For?

Some potential expenses a lifestyle spending account could cover include:

- Gym memberships and exercise classes

- Leisure activities such as movie tickets or weekend getaways

- Childcare services such as daycare or nannies

- Pet care expenses such as vet bills or food

- Professional development courses, workshops, or resources

- Mental health services such as therapy or counseling sessions

- Wellness initiatives such as nutrition counseling or health coaching

- Household services such as cleaning or gardening

- Home office equipment and decor such as plants or ergonomic furniture

- Travel expenses such as airfare or hotel costs

Lifestyle Spending Accounts vs. Health Savings Accounts vs. Flexible Spending Accounts

Lifestyle Spending Accounts (LSAs), Flexible Spending Accounts (FSAs), and Health Savings Accounts (HSAs) are three popular types of employee spending accounts. Understanding their differences is vital to make decisions that align with employees’ needs.

Lifestyle Spending Accounts

LSAs are employer-funded accounts that offer a flexible way to support diverse lifestyle and wellness needs of employees. These accounts can cover various expenses, from gym memberships to childcare, allowing employees to choose how they utilize their funds. These benefits are taxable for employees.

Flexible Spending Accounts

FSAs are employee-funded accounts primarily used for specific expenses like healthcare and dependent care. They offer tax savings by reducing taxable income. However, they have a “use-it-or-lose-it” policy, meaning funds must be utilized within the plan year.

Health Savings Accounts

HSAs are tax-advantaged accounts designated for medical expenses, available to those with High-Deductible Health Plans. Funds accumulate and roll over year after year, providing a long-term strategy for healthcare savings.

How To Set Up An Lifestyle Spending Account

To ensure a smooth implementation and successful adoption of LSAs in an organization, consider the following steps:

- Assess employee count and budget: Determine the total number of employees and allocate a budget for the LSAs, ensuring competitiveness within the industry.

- Decide spending per employee: Choose a timeframe for the LSAs (monthly, quarterly, semi-annually, or annually).

- Select spending categories: Align categories with company values and employee interests. Common categories include health and wellness, remote work, and leisure. Alternatively, give employees complete autonomy for what kinds of perks they choose.

- Choose an LSA vendor: Evaluate vendors, considering factors like:

- Tax compliance

- Funding models

- Personalization options.

- Communicate with employees: Clearly explain the LSA program details, including:

- Allowance

- Timeframe

- Rollover policies

- Available perks and eligible/non-eligible expenses

- Tax implications

- HR contact information

Top Lifestyle Spending Accounts For 2024

As LSAs become more popular, there is an explosion of providers, each with its own strengths and weaknesses. It can be difficult to know what each company offers, which features are a suitable fit for a given organization, and how relevant the marketplace and reimbursement options are to that organization’s demographic.

To ease the lifestyle spending account vendor search process, check out Wellable’s curated list below of the top lifestyle spending account companies in 2024.

Employee Benefits Corporation

Employers can use Employee Benefits Corporation’s LSA to establish an account to support workers’ daily needs without having to manage additional reimbursements. Each employee is unique, so EBS allows firms to provide employees with the option of using after-tax funds for costs not covered by typical benefits. Employers provide the program parameters using an LSA, specifying how much workers will get and what the money may be used for, and EBS handles the rest.

Wellable (Powered By ThrivePass)

Testimonial: ‘We wanted our employees to feel rewarded, and be able to offer some incentives that were not solely based on how physical they were able to be. The holistic approach is what we value, and we believe our employees do too.’ – A verified Wellable user.

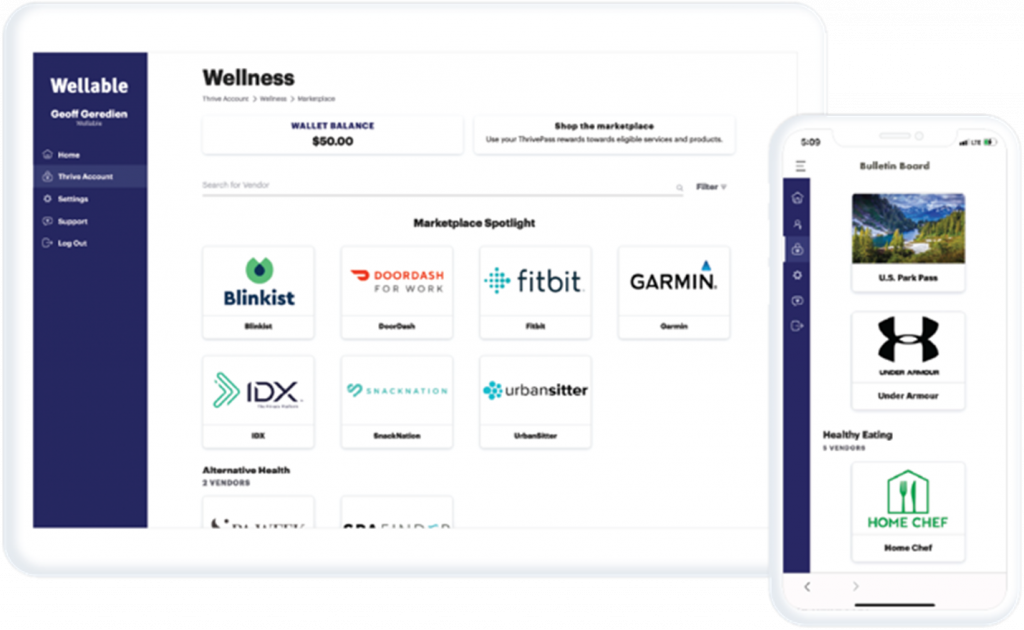

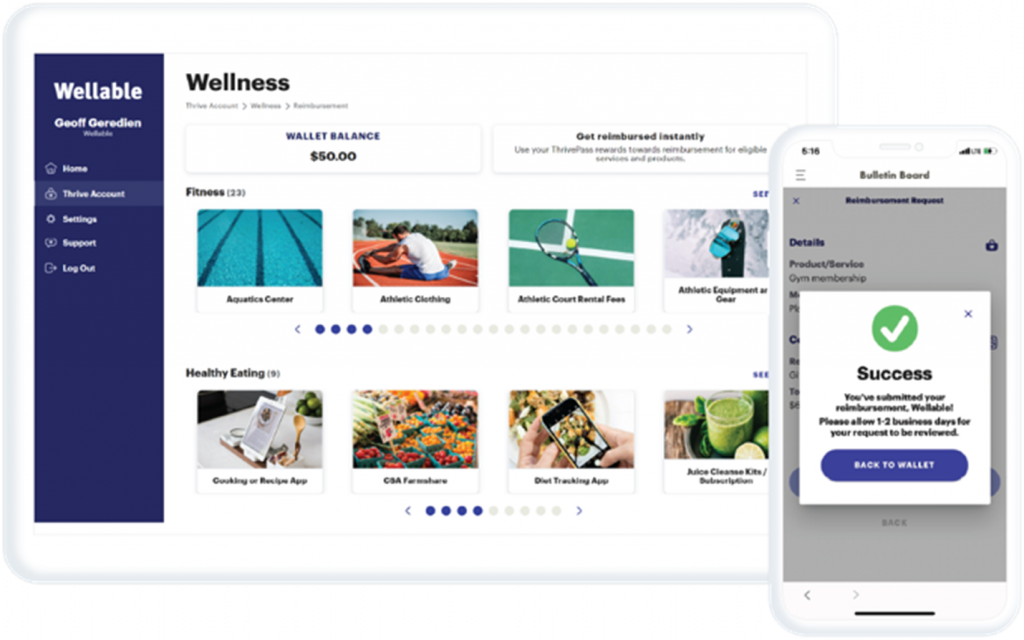

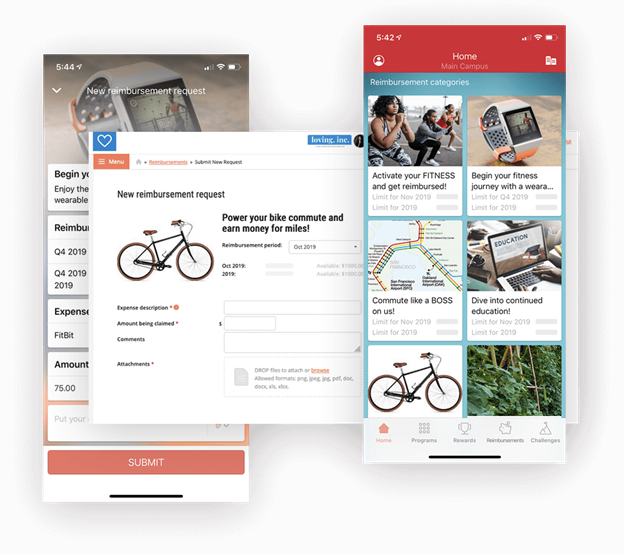

With Wellable’s Lifestyle Spending Account (powered by ThrivePass), companies can (1) automate rewards management, (2) simplify expense reimbursement, and (3) offer employees a diverse virtual marketplace. It is the best option for companies looking to boost engagement in their wellness program, but also an excellent choice as a standalone solution.

Automate Rewards Management: Employers choose the amount and frequency of contribution, as well as eligible expenses from over 100 spending categories. ThriveAccounts are accessible directly from Wellable’s Wellness Platform, providing a seamless user experience.

Simplify Expense Reimbursement: Reimbursement claims are verified by ThrivePass and can be authorized on the company’s behalf. Currency conversions are also provided for personnel based outside of the United States.

Diverse Virtual Marketplace: ThriveAccounts provide employees access to an online shopping experience with services, goods, digital apps, and other lifestyle businesses with exclusive promotions, discounted products, and early product releases. Employers have access to reports that give insight into employee engagement and expenditure trends.

Testimonial: ’The best thing I’ve ever done for me was Wellable. The program addresses both physical and mental health. Since I have always been physically active, being rewarded for the physical activity I perform on a daily basis has been fulfilling. Tracking my fitness journey has only pushed me to set and achieve new goals!’ – Nancy, a Wellable user.

Experience Wellable’s Integrated Lifestyle Spending Account

Thoughtfully-designed, holistic solutions that work for employers and employees.

No compromises.

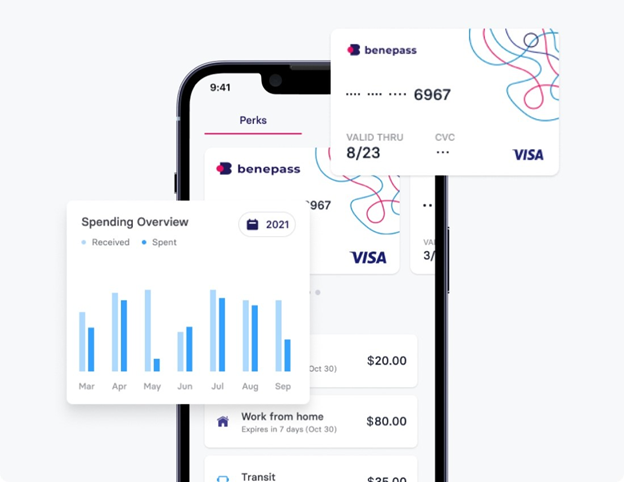

BenePass

Companies can give their workers the power of choice when it comes to their personal well-being goals using the Benepass LSA. Employers can specify what items qualify for their employees' lifestyle spending accounts: wellness, diet, mental health, career growth, and other elements can all be considered lifestyle pillars. Benepass works their magic by explicitly coding corporate regulations into the Benepass Platform and Visa Benecard, then interfaces to payroll systems to streamline enrollment, allowing teams to join the platform from day one.

Optum

Optum's Lifestyle Spending Accounts enable businesses to create a benefit plan that reflects their unique beliefs. Optum allows customers to design a strategy based on their employees' goals to assist them in addressing specific life issues. Then, clients may choose the eligible expenses, calculate the benefit amount, and set other parameters. Companies can also decide to provide the same benefit to all employees or tailor benefits to various segments. Optum has post-tax, family account, and crisis relief options.

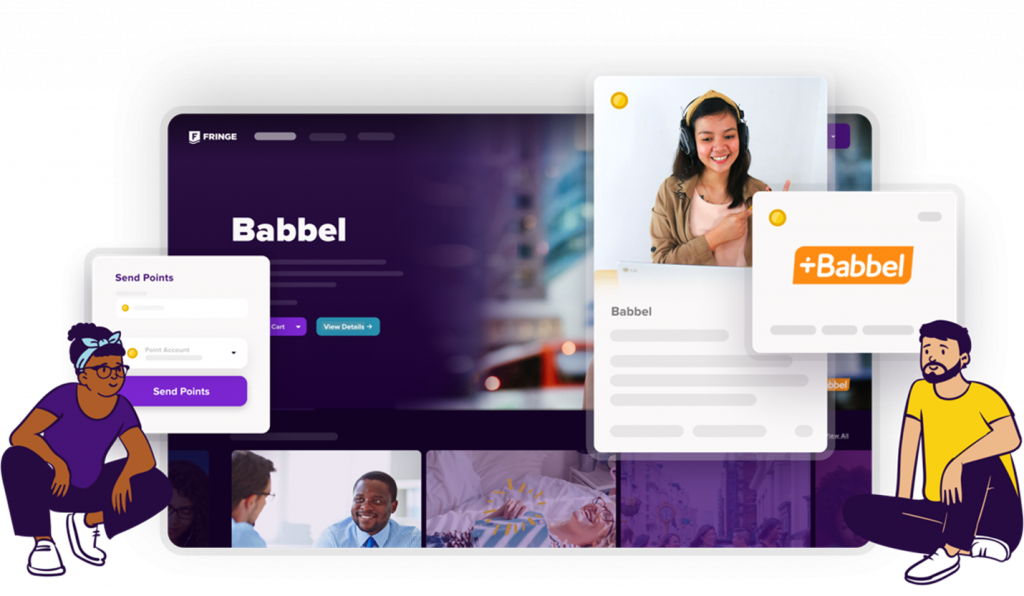

Fringe

Employers can offer a monthly, quarterly, or yearly stipend to employees and allow them to tailor their benefits to fit their lives using Fringe's Lifestyle Benefits Platform. Fringe will satisfy clients with best-in-class and diverse offerings, whether it is replacing a gym reimbursement or extending a lunch stipend program. Fringe is known for its quick launches, stipend points program, and is available in over 50 global locations!

WageWorks

WageWorks offers multiple Lifestyle Benefits Programs including a tuition reimbursement program, fitness reimbursement program, and a bicycle reimbursement program. Their tuition reimbursement program assists employees in achieving their educational objectives. Employees who participate in this employer-sponsored program are reimbursed for tuition and other expenses paid to schools, residencies, and other educational institutions. Their fitness reimbursement program can assist employees in saving money on healthy living choices. The bicycle reimbursement program encourages employees to travel to work in a healthy and ecologically responsible manner. This program is funded by the company and reimburses employees for normal bicycle expenditures.

WEX

WEX simplifies LSAs for everyone, from reducing your procedure to generating tailored experiences for participants. With its user-friendly benefits platform, businesses may monitor and change participant accounts, examine reports, and upload documents all in one spot. Increase efficiency by integrating with 350+ payroll/HRIS/benefit administration partners and over 225 insurance carriers. Create a consistent, user-friendly experience for employees by providing them with one modern, user-friendly online account, one bank card for all benefits, and one mobile app that allows them to easily control and manage their benefits even when they are on the go.

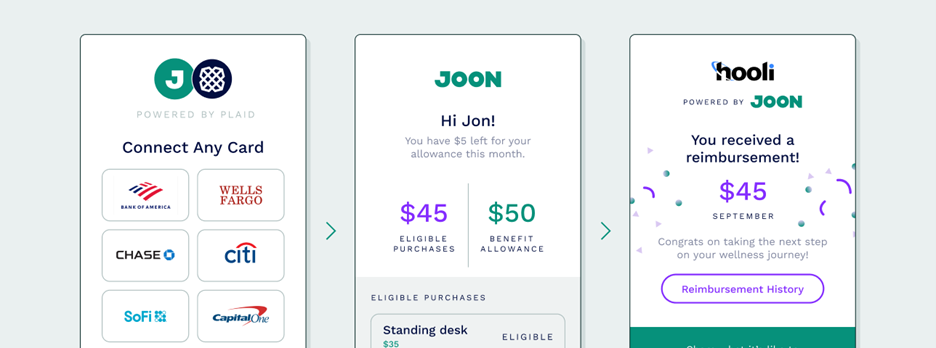

Joon

JOON is a flexible wellness benefits program that employees genuinely use and value. JOON is redefining advantages ranging from health and wellness to learning and development. JOON's card-connected experience is used by 100+ businesses to instantly turn any category or popular merchant, from Peloton to Udemy, into a reimbursable employee reward. JOON is one of the easiest ways to reimburse employees. Benefit users' expenditures are stretched even further thanks to unique savings at JOON's health and lifestyle partners.

Ameriflex

Employers can use Ameriflex's Lifestyle Spending Account to assist their employees with paying for health and wellness expenses, as well as other charges that aren't typically covered by a group health plan. Employers have control over which costs are paid and how much each employee receives. Employers pay the LSA with money that is taxed to the employee after they spend it, unlike other spending accounts such as their flexible spending accounts.

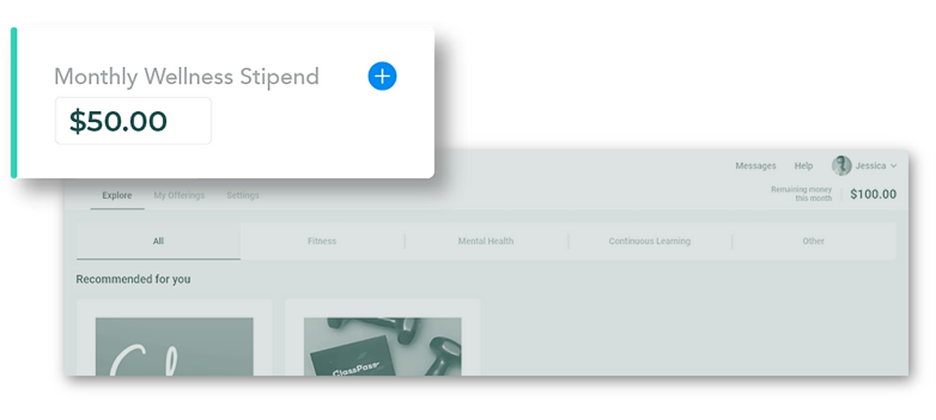

Holisticly

Holisticly is a completely integrated platform for managing wellness stipends. Simply establish an appropriate stipend, and then teams can select from a variety of their preferred goods and memberships. There will be no refunds or cards, just an amazing experience that employees will thank their employer for. Fitness, mental health, financial well-being, nutrition, and continuous learning solutions are among the many options. It’s simple to implement Holisticly any time of year!

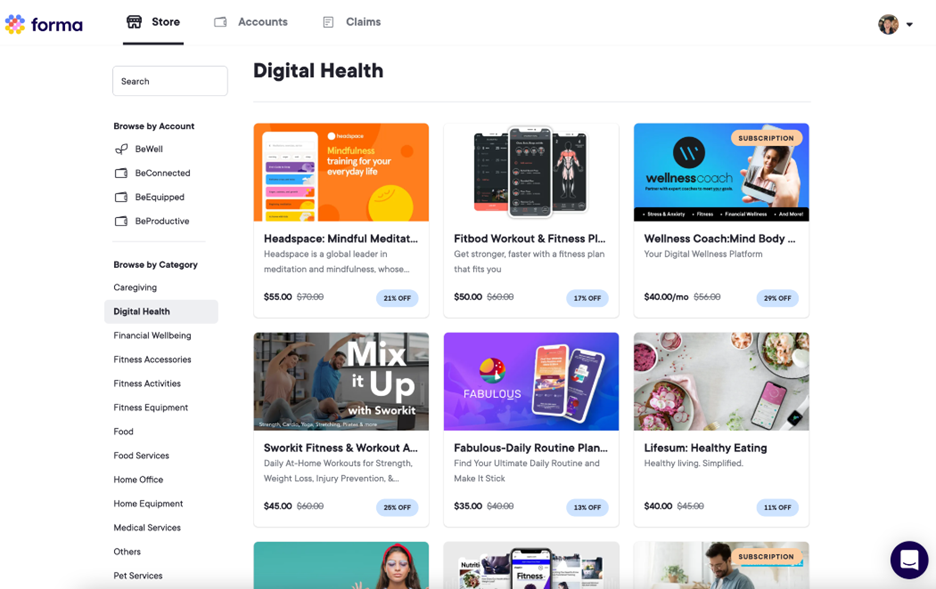

Forma

Forma Life Benefits prioritizes flexibility. Forma assists in curating a mix of benefits that stretch to match any lifestyle, from health insurance and PTO to gym classes and retirement plans. Forma’s lifestyle benefit categories include family & relationships, education & career, well-being & lifestyle, basic health & protection, money & wealth, and work & performance.

Advanced Benefit Strategies

ABS takes a hands-on approach to simplify and deliver solutions that eliminate the bother of employee benefit management. Create fully personalized, post-tax Lifestyle & Wellness accounts to promote healthy habits and general employee well-being. ABS allows companies to offer flexible and adjustable plans that employees desire, simplifies the participant's experience, and the whole offering can be managed in one location.

Espresa

With Espresa's Global Lifestyle Spending Account (LSA) + Employee Reimbursement platform, companies can give employees the flexibility to choose. Employee reimbursement initiatives pose a considerable strain to already overburdened HR personnel. The Espresa platform does this effectively, allowing businesses to support initiatives that highlight and showcase their culture benefits. Espresa gives HR total power over employee incentives. Create an infinite number of customized allowance plans by nation, currency, time zone, region, and employee classification. Furthermore, they will white label the platform to provide a distinctly branded experience.

NueSynergy

Companies sponsor and finance NueSynergy Lifestyle Spending Accounts (LSAs) to assist employees in supporting health and wellness activities in their life. Their LSA includes expenditures that are frequently reimbursed. If an organization wants to design an LSA for their workers, NueSynergy may assist them with choosing appropriate items and services, which are then administered through NueSynergy's system. This LSA gives flexibility to benefit plans and is simple for businesses to create and manage. Employees and their dependents can utilize the company's yearly employer contribution for anything that supports their health and wellness that is deemed eligible.

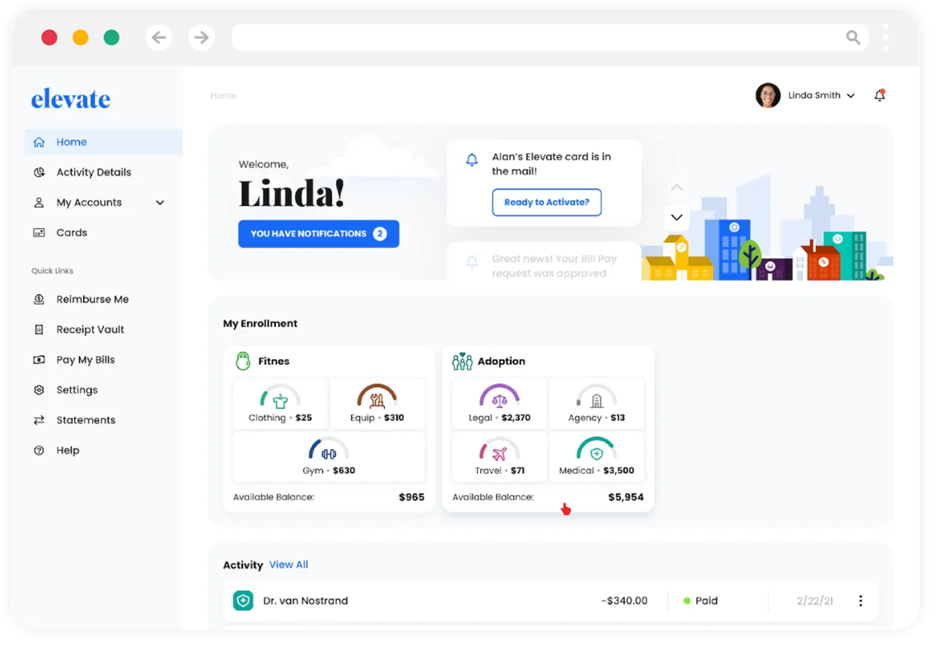

Elevate

Elevate's adjustable features make it simple to create and customize business benefit programs that bring specific concepts to life. Their easy-to-use, completely customizable plan generator gives businesses maximum flexibility – even at the sub-plan level. Employers may use Elevate's Lifestyle Programs to take advantage of fitness, fertility, tuition, or adoption benefits — or their own customized wellness programs.

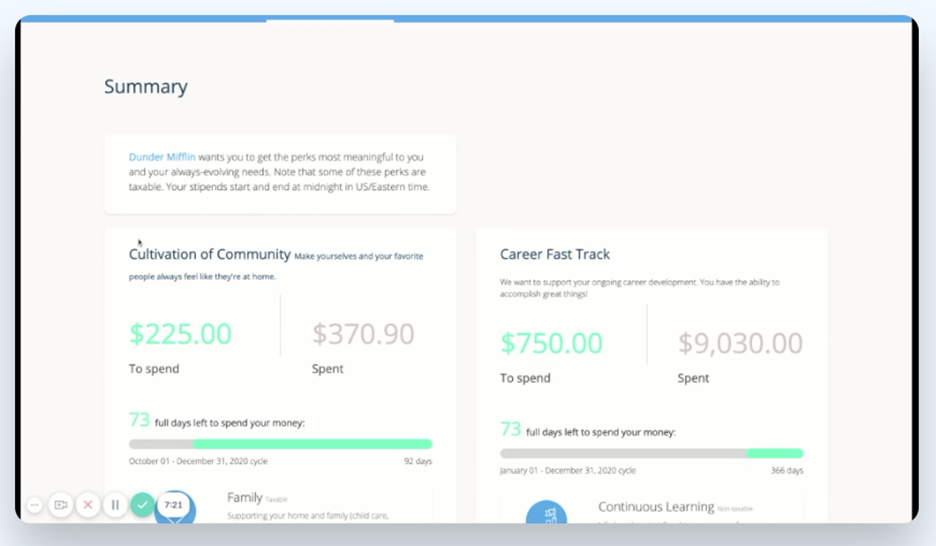

Compt

Compt provides perk stipends suited to the demands of a company's staff. Their software is used to create and scale employee benefit stipends so that companies may assist their team no matter where they live or what their current life situation is. Their user-friendly platform makes it simple to establish a personalized benefits program with limitless incentive alternatives. Compt's Employee Stipends program enables businesses to offer employee perks that align with their culture and attract talent, all without the complexity of DIY perk programs or point-based systems.

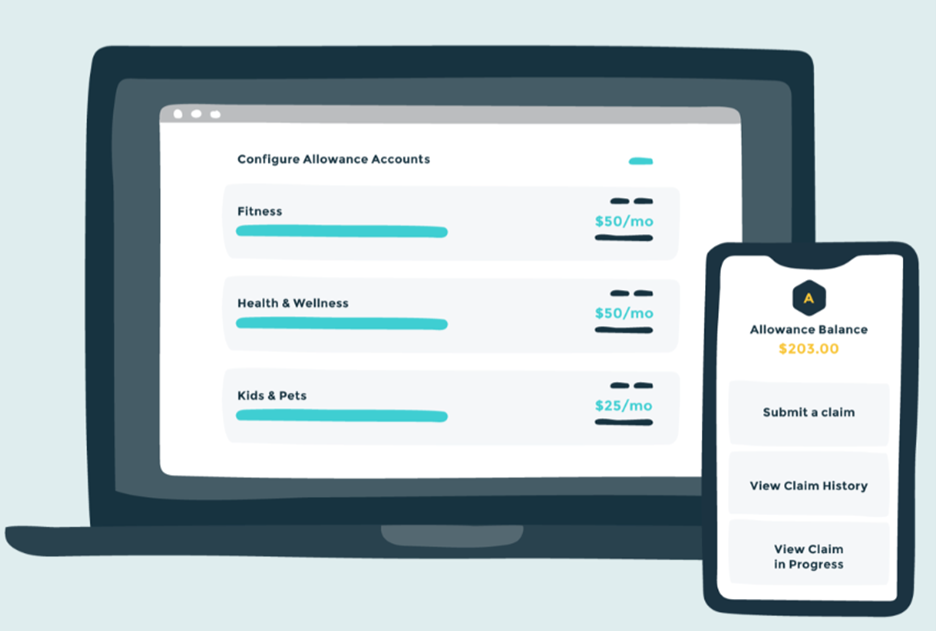

Honeybee

Honeybee allows businesses to deposit a predetermined amount of money into employee Allowance Accounts monthly. Employees may then spend those funds on a range of expenses in categories chosen by their company, much like a bank account. All through an easy-to-use app! Honeybee Allowance Accounts are a quick and simple method to eliminate the administrative burden of lifestyle benefits.

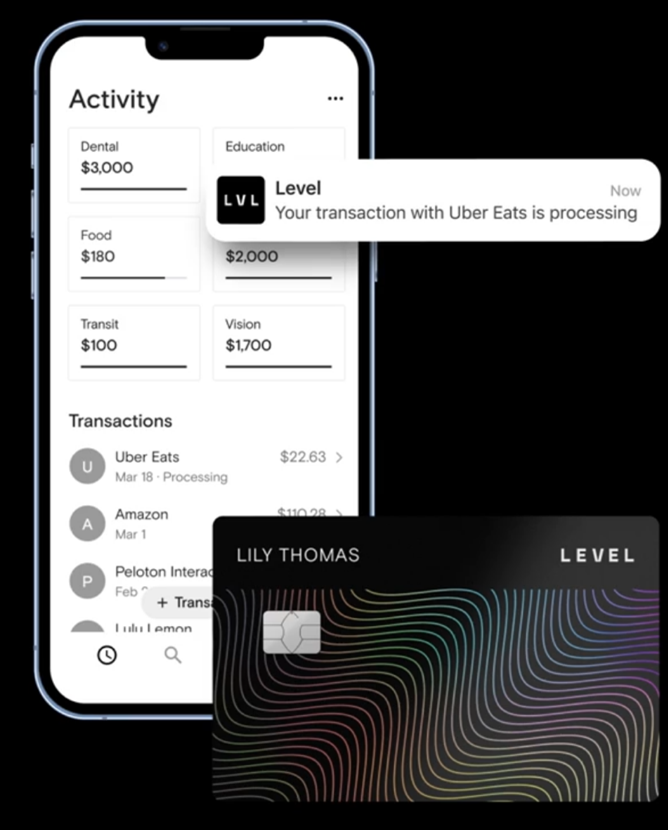

Level

Level offers a streamlined benefits experience with an employer-funded card for direct payments on eligible items, eliminating the reimbursement process. The Level app allows employees to manage expenses and access plan details, while HR professionals can use the employer dashboard for efficient benefits tracking and management.

IncentFit

IncentFit provides flexible reimbursement options for various expenses like fitness memberships and professional development courses. Employers have control over submission deadlines and payout methods, while IncentFit’s customer support team manually reviews and confirms all claims, ensuring they’re legitimate and fit the employer’s requirements. Their mobile app is user-friendly and makes the submission process hassle-free.

HealthKick

HealthKick's digital wellness wallet simplifies the administration of wellness stipends, offering access to an extensive network of over 500 health and wellness brands. They support companies with tailored communication, enrollment, and engagement strategies, addressing specific corporate needs and geographic locations.