In January 2024, Google Trends reported a 1,450% surge in searches for “retirement ages around the world,” signifying a growing concern about financial wellness. This apprehension is echoed in Betterment’s 2023 Retirement Readiness Report, which highlights a pervasive lack of confidence among workers in their retirement savings.

Post by @googletrendsView on Threads

Despite the importance of robust financial wellness benefits for job loyalty and performance, Wellable’s 2024 Employee Wellness Industry Trends report shows a decline in employer investment in such initiatives. This contrast points to the need for reevaluating financial well-being strategies in the workplace.

Pressed for time? Here’s a quick summary…

- Retirement age debate: Nikki Haley’s suggestion to raise the retirement age to 70 has sparked viral discussions on TikTok, heightening retirement anxieties.

- Retirement (un)readiness: Less than half of workers are confident about their retirement savings, and many are open to job changes for better financial benefits.

- Disconnect in employer response: Despite employee interest, there’s a reduction in employer investment in financial wellness programs for 2024.

- Workplace financial wellness: Fair, transparent pay, financial education, personalized coaching, and incentives like 401k and HSA/FSA contributions promote financial well-being at work.

Rising Tide Of Financial Wellness Concerns

The increased interest in search terms related to “retirement ages around the world” reflects deeper concerns about financial security and aspirations for a stable future. Societal and economic factors contribute to these concerns, such as Nikki Haley’s recent proposal to raise the retirement age to 70 for Americans currently in their 20s.

What you would do is, for those in their 20s coming into the system, we would change the retirement age so that it matches life expectancy

Nikki Haley, Republican presidential candidate

Haley’s plan, widely discussed on TikTok, is facing backlash from young people for shifting the retirement goalpost, exacerbating concerns about future stability.

Current State Of Retirement Readiness

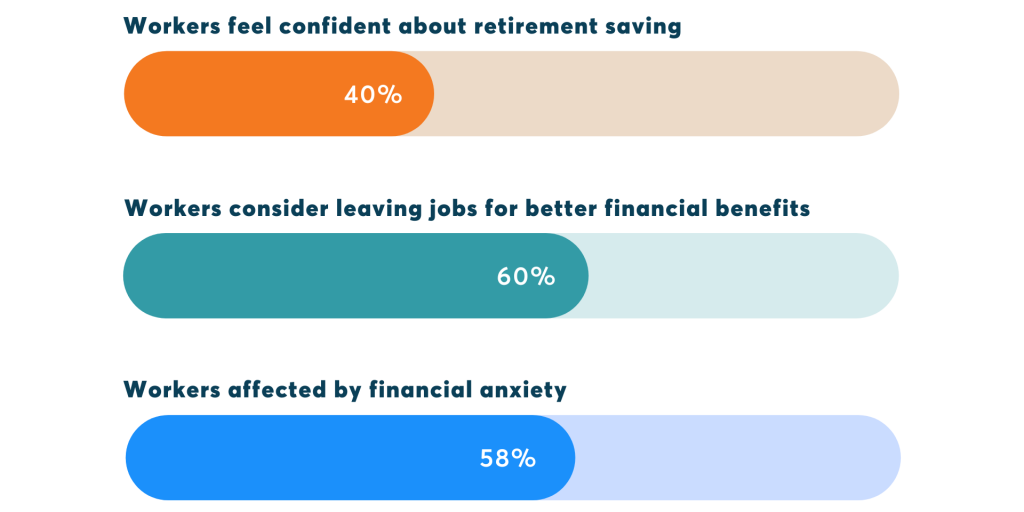

Betterment’s report reveals the concerning state of retirement readiness among workers:

- Only 40% feel confident about saving enough for retirement

- 60% would consider switching jobs for better financial benefits, a 6% increase from the previous year

- 58% report that financial anxiety hinders their focus at work

This data highlights a substantial gap between employees’ desires for financial security and their preparedness. The impact of financial anxiety is profound, affecting both personal well-being and professional performance and satisfaction.

Disconnect In Employer Response

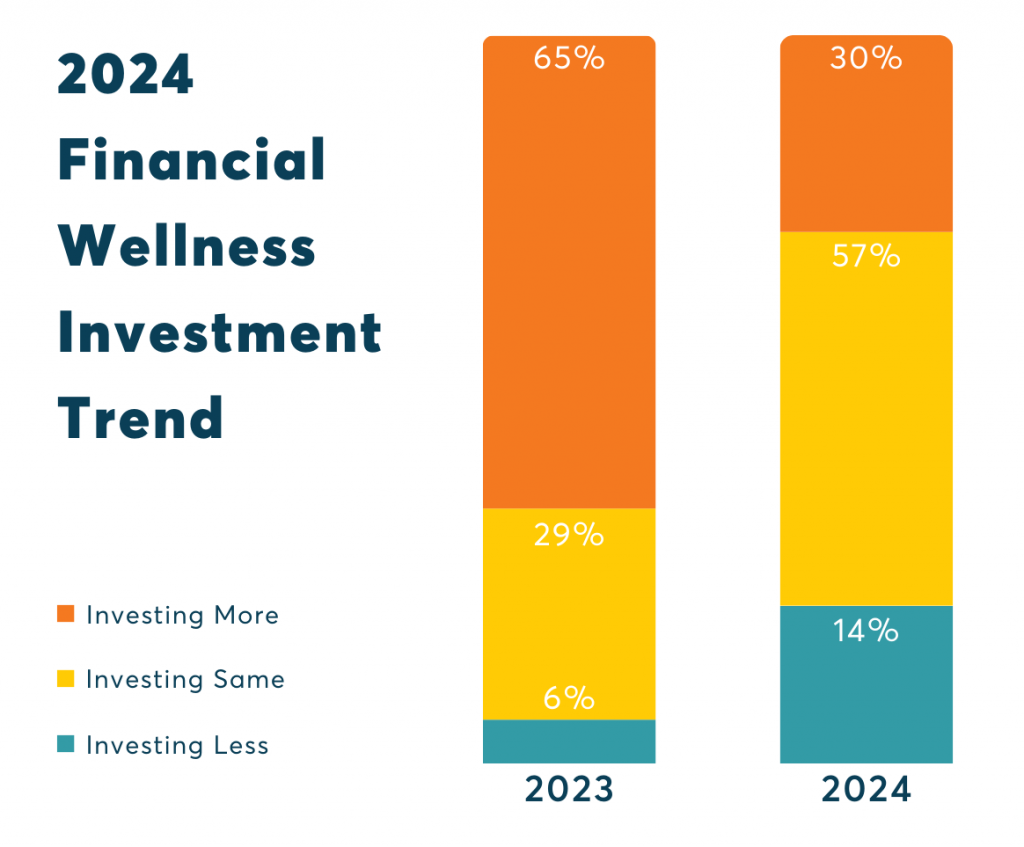

Despite employee concern and interest, Wellable’s 2024 Employee Wellness Industry Trends report shows a reduction in employer investment in financial wellness programs:

- There’s a significant decrease in the proportion of companies increasing their investment in these programs, dropping from 65% in 2023 to just 30% in 2024

- The percentage of companies maintaining their current investment level has nearly doubled, rising from 29% in 2023 to 57% in 2024

- There’s a notable increase in companies reducing their investment, from 6% in 2023 to 14% in 2024

This pullback may stem from the stabilization of the broader economic climate, potentially shifting employers’ attention to other issues like escalating healthcare costs. However, neglecting financial wellness could have long-term impacts on employee satisfaction, retention, and productivity.

Improving Financial Wellness Initiatives

Financial wellness programs are mutually beneficial for employees and employers. For employees, they offer peace of mind and security about their financial future. For employers, these programs are an investment in creating a stable, focused workforce, leading to potential reductions in turnover and boosts in loyalty.

Key components of a well-rounded approach to financial wellness include:

- Fair pay & transparency: Align base salary, bonuses, benefits, and equity compensation with industry standards and competition to attract and retain talent. Clear communication about compensation structure, including salary bands and criteria for raises or promotions, is crucial for promoting trust, motivation, and fairness.

- Financial education: Offering workshops or online resources about budgeting, debt management, and investment can empower employees to make informed financial decisions. This could include seminars on retirement planning or access to financial planning tools.

- Personalized coaching: Providing one-on-one sessions with financial advisors allows employees to receive guidance tailored to their unique financial situations. This can cover topics from saving for a home to managing student loans.

- Incentivizing savings: Matching contributions for 401k plans or offering contributions to HSAs/FSAs can encourage consistent saving habits.

- Lifestyle spending accounts (LSAs): LSAs offer flexibility for various personal expenses, from wellness activities to continuing education, allowing employees to invest in what matters most to them.

- Regular financial health check-ups: Encourage employees to periodically review their financial status through annual financial wellness workshops or check-in meetings, helping them stay on track with their goals and adjust plans as needed.