Payscale’s 8th Annual Salary Budget Survey reveals a surprising shift: 22% of US companies plan to cut salary raise budgets next year. Amid employee expectations for salary growth, organizations must strike a balance between meeting workforce needs and maintaining financial stability during an unpredictable economic landscape.

This article unpacks key insights from the survey, highlights factors influencing salary trends, and offers insights for HR and compensation professionals.

Pressed for time? Here’s a quick summary…

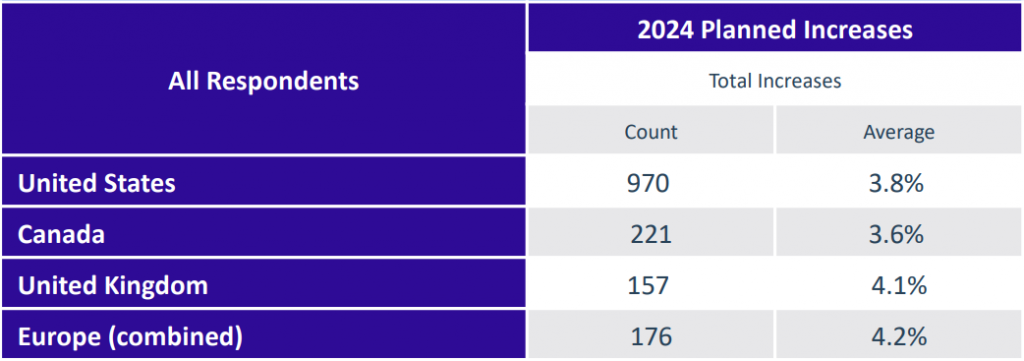

- Anticipated salary budget for 2024: Organizations anticipate a 3.8% salary budget increase for 2024, considering the increase that outpaced expectations in 2023. Thus, the planned salary increase budget is flat year over year.

- Economic factors: Declining inflationary pressure and a cooling labor market have prompted companies to reassess their wage growth strategies.

- The rise of the ‘richcession’: Job losses have disproportionately impacted white-collar workers, a paradigm deemed a ‘richcession’.

- It’s not all about money: Compensation extends beyond immediate salary, encompassing a comprehensive suite of benefits and policies that improve employees’ financial well-being and overall job satisfaction.

Key Insights From The Survey

As the 2023-2024 salary budgeting season unfolds, the survey draws insights from 1,757 organizations evaluated between April and June of this year:

- 22% of US companies expect to reduce salary raise budgets in 2024, a notable change when compared to 9% last year.

- Planned salary increase budgets are flat year over year.

- The average salary increase varies by industry, with the largest increases planned in the energy, food, beverage, and hospitality sectors.

Historical Context: Salary Increase Over The Years

The standard salary increase budget hovered around 3% pre-pandemic, representing a universal benchmark for compensation growth. However, the aftermath of COVID-19 has significantly altered the global landscape. Economic fluctuations, changes in the job market, and evolving work conditions have contributed to shifts in compensation structures. As evidence of this change, in 2023, the actual salary increase rate was 4%, a full percentage point higher than the pre-pandemic norm.

Why Are Some Companies Limiting Salary Increases?

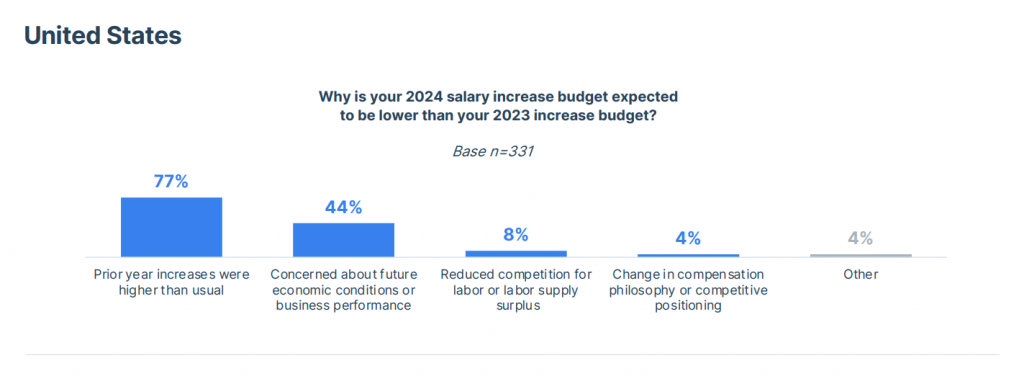

Balancing Out The Prior Year

The discrepancy between last year’s projected and actual salary increase rates appears to be a driving factor in budget cuts. 77% of US companies that anticipate a reduction in their 2024 salary increase budget compared to the 2023 figures attribute this adjustment to elevated prior-year increases.

Lower Inflation

Inflation, which surged to a 9.1% peak last year, has since moderated to about 3%. Declining inflationary pressure has prompted companies to recalibrate their salary increase projections in response to the changing cost of living.

Cooling Labor Market

Unemployment rates lingered around 3.4% in January, but the market has slightly relaxed with unemployment rates rising to 3.6% by May. This shift, while not dramatic, has prompted companies to reassess their wage growth strategies as they adapt to a slightly less competitive hiring landscape.

Contradictory to these conservative projections is the robust wage growth of 6.1% reported for Q2 2023, reflecting an upward trajectory in earnings. Amidst a complex economic environment, companies are challenged with striking a balance between addressing employees’ expectations for higher pay increases and broader economic trends.

Underlying Influences On Salary Budgets

Global Economic Uncertainty

Global economic conditions and persistent predictions of a looming recession cast a shadow on decision-making. Despite these forecasts, the US economy has shown resilience, with:

- Growth in the first half of 2023

- Strong labor market conditions

- Resilient consumer spending

The buoyancy of the labor market paired with resilient consumer spending patterns adds a layer of complexity to the decision-making process, prompting companies to tread cautiously in an evolving economic landscape.

‘Richcession’ Realities

Job losses have disproportionately impacted white-collar workers, a paradigm deemed a ‘richcession’. This paints a picture of an uneven economic landscape, where the demand for and wages of lower-income groups are outpacing those of higher-income groups. The waves of layoffs in sectors like tech and banking have instilled concerns about a potential recession still looming.

In most recessions, unemployment rises more for lower-income groups. Although we are not in an overall recession yet, the demand for and wages of lower-income groups are outpacing higher-income groups.

Tomas Philipson, Professor of Public Policy Studies at the University of Chicago and former Acting Chair of the White House Council of Economic Advisers

Implications For HR & Compensation Professionals

While this data can guide HR and compensation professionals in shaping compensation strategies, it’s crucial to consider the impact of various factors on decision-making.

Collecting Niche Data

To design compensation plans that align with an organization’s unique characteristics, account for factors such as:

- Company size

- Industry

- Location

- Job roles and responsibilities

This customization ensures compensation remains competitive within industry norms, aligns with local economic contexts, and fairly reflects the contributions of the workforce.

Balancing Employee Expectations For Total Compensation

Organizations face the difficult task of navigating employee expectations amid the backdrop of mounting inflation and persistent wage growth. Striking an equilibrium among these expectations, practical compensation strategies, and fiscal responsibility is paramount to attract and retain top talent while fostering a financially sustainable environment.

This balance extends beyond immediate salary, encompassing a comprehensive suite of benefits and policies that improve employees’ financial well-being and holistic job satisfaction. This includes:

- Health insurance premiums

- Professional development reimbursement

- 401k contributions

- LSA contributions

One survey noted additional factors that contribute to overall employee happiness, such as:

- Supportive management

- Flexible hours and work arrangement autonomy

- Meaningful work

- Positive company culture

These aspects align with the understanding that employees seek work-life balance and fulfillment extending beyond monetary rewards. As modern employee preferences continue to diversify, a holistic approach ensures that compensation strategies remain attuned to the dynamic needs and aspirations of the workforce.